OPEC too slow for Covid's ever-changing world

OPEC faces a very uncertain outlook for demand in the first half of 2021

image for illustrative purpose

Oil producers need a mechanism allowing them to respond quickly to changes that could be both big and fast.

They face a very uncertain outlook for demand in the first half of next year. If vaccine rollouts are widespread and smooth, the need for OPEC crude could rise quickly. But demand could be curtailed again if economic growth falters amid further lockdowns or inoculation delays. Either way, the cartel must to be able to respond swiftly to a changing environment.

Oil ministers from the Organization of Petroleum Exporting Countries (OPEC) and their allies in the wider OPEC+ group, which includes Russia and Kazakhstan, are meeting next Monday and Tuesday. They are due to decide whether to extend their current output cuts of 7.7 million barrels a day into next year, or ease them, as was originally planned, by 1.9 million barrels from the start of January.

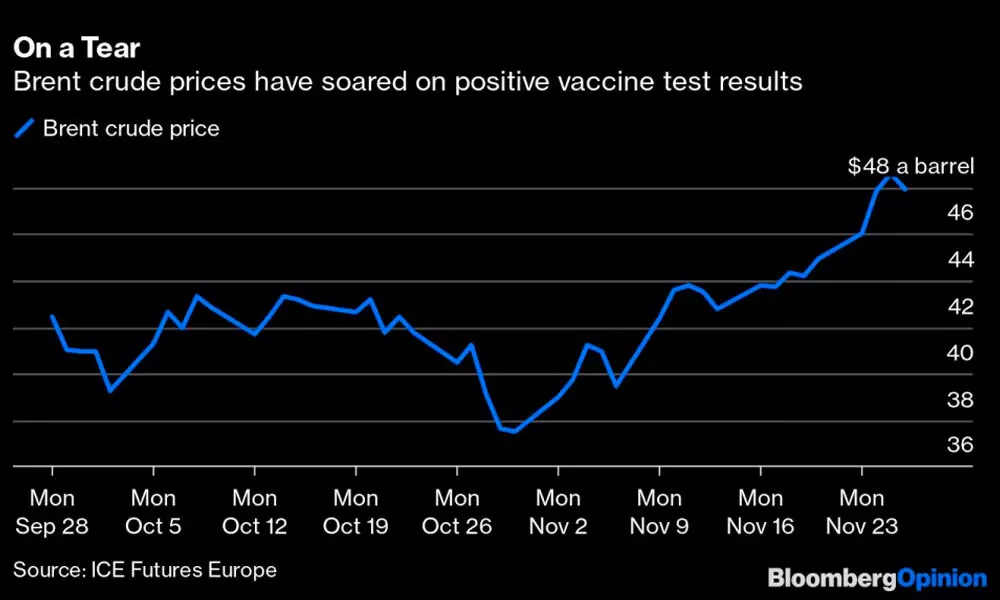

The most likely outcome remains an extension of the current level of cuts, probably through the first quarter of 2021. But a surge in oil prices, which have risen by as much as 30 per cent since the beginning of the month, has already called that outcome into question.

But even with the current vaccine euphoria, producers need to brace themselves for waves of uncertainty.

No matter if the recovery picks up speed again, there are still huge stockpiles of crude and refined products that need to be drawn down before the oil market gets back to any sustainable balance. Figures from OPEC's own analysts indicate that the amount of oil held in tanks, caverns, ships and supply chains will be almost 1.3 billion barrels higher at the end of 2020 than it was at the beginning.

Careful market management is therefore going to be needed for many months to come. If the delivery of vaccines falters for any reason, producers will need to keep a tight grip on supply. If there are ample quantities of cheap, easily stored and transported shots available early next year, there could well be a sudden surge of pent-up demand.

While the producer group's members would undoubtedly like to see higher oil prices — they always do — they are also wary of triggering the start of a third US shale boom. Analysts at Standard Chartered wrote back in September that WTI crude prices for 2021 needed to rise to $45-$50 a barrel for any sustained increases in either producer hedging or oil drilling activity. They've gotten there.

Fortunately for the producers, they already have a mechanism for greater flexibility in their Joint Ministerial Monitoring Committee, which meets every month. They are helped, too, by the move to virtual meetings. It's easier to coordinate their diaries when they don't have to block out several days of travel to OPEC's Vienna headquarters.

The problem remains, though, that with some countries pushing for special treatment and others questioning their commitment to the whole OPEC project, nobody wants to relinquish their seat at the decision-making table.

At the start of the pandemic, the OPEC+ alliance found itself in disarray. Russia refused to accept deeper output cuts at their March meeting, triggering a brief free-for-all that took crude prices below $20 a barrel. A meeting in April dragged on for days when Mexico refused to accept reductions that lasted more than a month. The country eventually delivered a record output cut of 10 million barrel a day after a smoke-and-mirror arrangement that saw President Donald Trump offer up some of the US output cuts in Mexico's place.

It saddens me to find I'm repeating myself. When Covid-19 was first beginning to emerge back in February, I wrote that the producers have to be able to "react quickly to the rapidly-changing world around them." They failed then. Let's hope they can pull it off this time. (Bloomberg)

OPEC's oil output:

♦ OPEC's current oil output cut - 7.7 million barrels a day

♦ OPEC planned to ease oil output from January 2020 - 1.9 million barrels a day